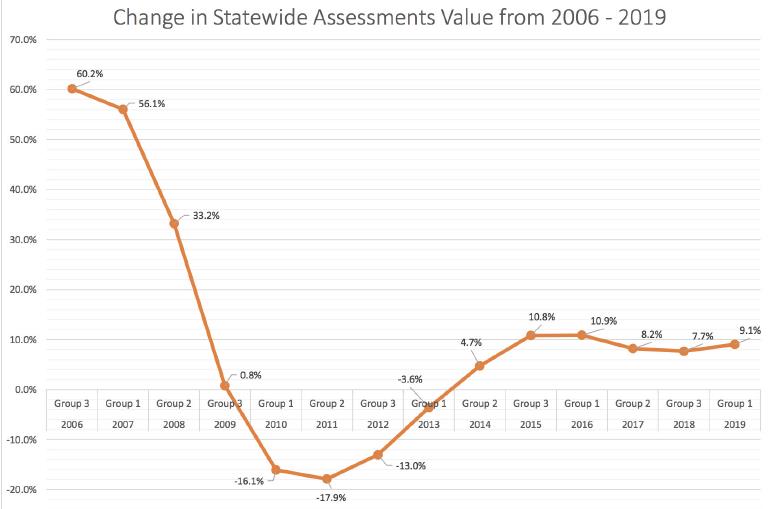

ANNAPOLIS—The Maryland State Department of Assessments and Taxation (SDAT) has announced its 2019 reassessment of 696,947 residential and commercial properties. The overall statewide increase for "Group 1" properties was 9.1%; this is the first reassessment since 2008 where all 23 counties and Baltimore City posted an increase. The properties in "Group 1" are reassessed by the Department every three years and account for one-third of the more than two million real property accounts in the state. This represents an average increase in value of 8.2% for all residential properties and 12.5% for all commercial properties since they were last assessed in 2016.

St. Mary's County showed an overall 6.27 percent increase, with residential properties increasing by 5.9 percent and commercial properties by 10.2 percent, all lower than the state average. St. Mary's wound up the lowest of the three Southern Maryland counties, showing a smaller increase than Calvert (7 percent) and Charles (12.2) percent. Charles outpaced the state average.

St. Mary's average reassessment increase was 31.8 percent lower than the state average and Calvert's was 23.1 percent lower. Thirteen of the state's 23 counties were higher than Calvert and 16 higher than St. Mary's.

The 2019 assessments for Group 1 properties were based on an evaluation of 64,807 sales that occurred within the group over the last three years. If the reassessment resulted in a property value being adjusted, any increase in value will be phased in equally over the next three years, while any decrease in value will be fully implemented in the 2019 tax year. For the 2019 reassessment, 87.5% of Group 1 residential properties saw an increase in property value.

"Thank you to all of SDAT's real property assessors throughout Maryland for the hard work and dedication they have displayed this year to ensure that Maryland's properties continue to be assessed fairly and uniformly," said SDAT Director Michael Higgs. "As part of our ongoing tax credit awareness campaign, our Department is also dedicating an entire page in each reassessment notice to provide information about the Homeowners' and Homestead Tax Credits, which save Marylanders more than $260 million in taxes each year."

The Homeowners' Tax Credit provides relief for eligible homeowners by setting a limit on the amount of property taxes that are owed based on their income. Residential property owners who complete a one-time application and meet certain eligibility requirements can also receive a Homestead Tax Credit, which limits their principal residence's taxable assessment from increasing by more than a certain percentage each year regardless of their income level. Although statewide legislation caps the increase at no more than 10% per year, many local governments have established property tax caps at lower percentages.

Property tax assessment notices were mailed out to Group 1 property owners on Thursday, December 27, 2018.

Reassessments Show Statewide Increase, St. Mary's Change Below State Average

Source: Maryland State Department of Assessments and Taxation (SDAT).