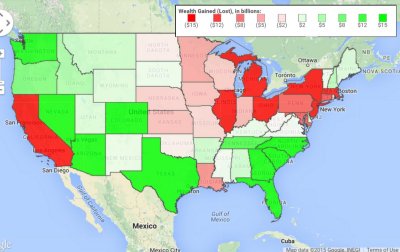

Map by "How Money Walks" shows states losing taxpayers in red and states gaining in green. For a larger interactive map with details for each state, click on the image above or go to www.howmoneywalks.com/irs-tax-migration

Recently released data from the IRS shows that about 5,500 more taxpayers left Maryland in 2012 than moved to the state.

Long-cited by tax critics as annual data that show the migration of taxpayers to lower-taxed states, some experts caution that not too much should be read into year-to-year changes.

“The IRS data presents a snapshot in time for Maryland,” said Daraius Irani, chief economist at the Regional Economic Studies Institute of Towson University. “While many would argue that aha, ‘MD is a high tax state and therefore people are leaving as a result,’ this is a fallacy as it confuses causality with correlation.”

But some argue it shows where dollars are moving and jobs are being maintained and generated – an important factor for policymakers to consider. The IRS migration data is based on the address of record on individual income tax returns filed and received by the IRS from Jan. 1 to Dec. 31 of 2012 (for tax year 2011) and 2013 (tax year 2012).

An analysis of the data for the campaign of Republican Congressional candidate Mark Plaster found Maryland had a net decline of 5,596 taxpayers, with an adjusted gross income totaling $1,633,487,000.

Winners, losers

The state ranked 45th for net taxpayer income change and 47th in terms of percentage, with a .9% decline in taxpayer adjusted gross income, trailed only by Illinois, Connecticut and Alaska. Nevada topped the list, with a net gain 1.97% adjusted gross income. In terms of total net adjusted gross income, Florida, Texas and South Carolina saw the biggest gains with $8.3 billion, $6 billion and $1.6 billion respectively.

Within local jurisdictions, Kent and Queen Anne's counties gained the most in terms of percentage, with Charles County, Baltimore City and Montgomery County losing the most percentage wise.

Plaster was concerned about Baltimore’s numbers, which showed 20,123 taxpayers left and 18,361 went in, for an overall decline of 1,762. That represented an adjusted gross income of $1,165,079,000 going out and $850,171,000 coming in – a net decline of $314,908,000 or about -3.05% of the static tax base. He said solutions need to address why people are leaving one of ‘America’s great cities.’

“Baltimore is a very sick patient and for 50 years Democrats have relied on ever-increasing 'investments' as the magical cure for everything that ails Baltimore, and the sad results are in,” Plaster said in a statement. “Government at all levels needs to think through how to create the conditions for economic growth and job creation - it is Baltimore's best and only hope."

Motives for moving

Still, the numbers don’t tell the motives of people moving.

Irani said that people could move due to the weather, retirement or new job opportunities, and because of the state’s size and location they may continue to work in the state while moving elsewhere.

The data show that Maryland lost the most residents to Virginia (12,836), the District of Columbia (8,842), and Florida (7,285), and gained from Virginia (12,625), D.C. (9,434), and Pennsylvania (7,258).

“These data by themselves tell us nothing of note and unless someone undertakes sophisticated econometric analysis of the raw data, one can only speculate as to why households may move,” he said.

Benjamin Orr, executive director of the Maryland Center on Economic Policy, said that the information shows some sense of migration, but it should not be mischaracterized.

“Most people can’t take their income with them when they leave the state,” Orr said. He noted that if someone leaves for a new job, the company will likely replace that employee so the income doesn’t leave the state. Or if a doctor retires, other doctors in the area will gain those patients.

“It implies that wealth is generally fleeing the state. In fact what we find is that Maryland has a growing population,” he said. “We still have one of the highest median incomes in the country, we still have the highest concentrations of millionaires on a per capita basis in the country, and we have one of the greatest numbers of ultra-high net worth individuals.”

Overall, the Maryland Department of Planning reports that based on data from the U.S. Bureau of Economic Analysis, annual total personal income rose in Maryland by $7.9 billion between 2011-2012 using constant 2009 dollars, or by $10.9 billion using current dollars, and per capita income rose by 2.8%. That data shows Maryland’s total annual personal income has changed by less than 4% each year since 2004.

But consultant Jim Pettit, who compiled the numbers for the Plaster campaign, said that there are reasons to consider the more specific migration data and pointed to a blog that maps the data to see a bigger picture.

Pettit said a Gallup poll that found Maryland had the third-most residents who planned to leave the state in the nation, also cited that 31% nationwide plan to move where the jobs are, not for factors like weather or family.

He also said tax-friendly organizations are “in denial about facts that show low-taxes and a good business climate attract taxpayers.” He noted the top two states with adjusted gross income net growth were Florida and Texas with no state income taxes, and losing were New York and California.