Source: Minimum wage poll results by Gonzales Research and Marketing Strategies.

Progressive Democrats are using new polling results to continue their push for increasing Maryland’s minimum wage to $10 an hour, while they reject attempts to lower corporate taxes.

A minimum wage hike and corporate tax cut are being discussed by General Assembly leaders ahead of the 2014 session.

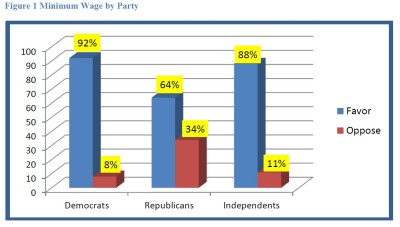

The survey conducted by Gonzales Research and Marketing Strategies for Progressive Maryland, a coalition of liberal groups, found overwhelming support for increasing the minimum wage from $7.25 to $10.10, with more than 82% favoring the move. Support was strong from all groups — Democrats, Independents and even Republicans, as well as whites, blacks, men and women.

The results are similar to those found in a Goucher College poll released last week, but the Gonzales poll used a larger sample of 819, and surveyed only likely voters. The margin of error was 3.5%.

The poll also found 56% opposed reducing the corporate income tax rate from 8.25%. Respondents were not told that the rate is higher than neighboring states.

Combined reporting backed

In a question paid for by the United Food and Commercial Workers union about a corporate tax method called “combined reporting,” those surveyed were given additional information that may have influenced their strong 70% support for the method that has been introduced every year by liberal legislators but opposed by business groups.

This is how the question was framed:

“Combined reporting” is part of the corporate income tax laws in a majority of states, but not in Maryland. Currently, corporations in Maryland can shelter their profits from taxation by shifting them to related companies in other states. “Combined reporting” would prevent this. Would you favor or oppose a law requiring Maryland corporations to file their taxes using “combined reporting?”

A commission studied the proposal several years ago, and found some Maryland companies such as utilities would save money under a combined reporting scheme and others, particularly large retailers and financial services firms, would wind up paying more taxes.

Reacting to the poll, Progressive Maryland’s Executive Director Kate Planco Waybright said, “Combined reporting is the most effective means of countering complex tax avoidance schemes devised by corporate lawyers and accountants to hide profits from state taxation.”

“Closing this gaping tax loophole that now allows big companies to shelter their profits from being taxed in Maryland would typically raise about $90 to $140 million more in badly needed revenue per year. It would add equity and level the playing field for small businesses, which compete against national chains like Walmart and Pizza Hut that often pay no corporate income tax in Maryland.”

UPDATED Wed. 10:15 a.m.: “We think it would be hard to accurately describe combined reporting in a two-sentence poll question,” said Will Burns of the Maryland Chamber of Commerce. “It is a complicated and nuanced corporate taxing system with multiple variables. To think that we could and should condense such a complex system down for the public so we could legislate by polls is not the direction that we should go.”

Burns said his shows the need to make Maryland even more competitive “in terms of economic growth, business investment and job creation—a task we are working towards through a Maryland Competitiveness Coalition.”