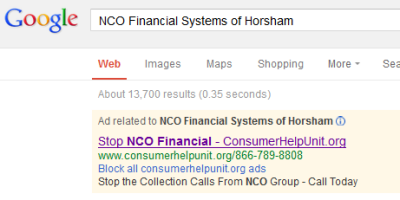

Four of the top 10 results of a Google search on the collection firm's name resulted in sites with consumer complaints about the company--many of which complain about difficulties in contacting NCO. A featured paid advertisement at the top of the Google results could be interpreted to be for a service opposed to the company's collection practices. In fact the advertised site is run by the collection company. Of the 5 categories on the site to "Stop the Calls," the top 2 are for incorrect reporting on a credit report and NCO contacting the wrong person. A testimonial posted on the site indicates a problem one consumer had when dealing with NCO: "After three days of ongoing phone calls, blood, sweat and tears I was starting to become angry, frustrated and beginning to loose hope. When my case fell into Harry's lap he took it over and in a timely positive manner had it completely under control." (screen capture and caption by somd.com)

A Pennsylvania collections firm has done so well prying Maryland back taxes out of delinquent taxpayers that the comptroller’s office just got approval for $300,000 more from the Board of Public Works to pay the agency’s commissions.

NCO Financial Systems of Horsham, Pa. collected $33 million from delinquent tax accounts since 2009– 22% more than the original estimate of $27 million. The firm gets a 5.35% commission on any money it collects.

With the approval of the comptroller’s latest request, NCO will have received $1.8 million in commissions since 2009, according to the board’s summary of the request. (page 82).

However, at Wednesday’s meeting, NCO lost out on a new three-year contract for tax collections to another Pennsylvania firm, Penn Credit of Harrisburg, which bid a commission rate of 4.54% on similar terms. (page 35 or 5B in the summary) Penn Credit was also rated higher on technical factors. NCO had proposed a commission rate of 5.85%, .5% more than it is currently receiving.

Only one Maryland firm was among the seven qualified bidders on the new contract.

Third request this year

Under its current two-year contract with modifications, NCO has received $825,750–up from the $775,750 approved back in 2011. The latest request will be the third request this year.

The current contract expires June 30. The comptroller estimates the latest contract–which began in 2011–to have brought in $15 million.

NCO’s original contract from July 1, 2009 to June 30, 2011 paid $676,240 in commissions.

New request will pay for work already started

The new request would allow the Comptroller to continue to pay the outside firm for collection services it has already started.

“It’s essentially picking up the gap between what we thought they were going to be able to collect and what their commission would be to what they’ve actually collected and what their commission is now,” said Andrew Friedson, the comptroller’s communications director.

Asked why the estimates were so low, Friedson explained that the original estimate was a “good-faith estimate for how much the vendor would successfully collect from these delinquent accounts which are very difficult to collect, and as a result, hard to precisely predict.”

NCO Financial Systems could not be reached for comment.

“The fact that the contractor performed well-beyond expectations set forth in the contract is great news for the state — generating millions in unexpected revenue — and more importantly, it’s great news for the vast majority of taxpayers who do the right thing and pay their taxes on time,” wrote Friedson in a follow-up e-mail.

“Thanks to the diligent work of his compliance team, strategic partnerships and innovative tax collection advancements, the agency has successfully collected over $3.1 billion in heretofore essentially uncollectible taxes since Comptroller Franchot took office in 2007,” he continued.

Outsourcing since the 1980s

Comptrollers have been outsourcing collection services to private companies since the 1980s, handling delinquent tax accounts from taxpayers or businesses who are “entirely non-responsive for an extended period of time,” Friedson said.

Many times, out-of-state businesses are some of these unresponsive taxpayers.

“These are the more most difficult collections that otherwise would be uncollectable,” Friedson said.

If you’ve had a problem with what you consider overzealous tax collection by state employees or outside collection agencies, please contact Len@MarylandReporter.com, 410-312-9840.