By KATE PRAHLAD, Capital News Service

New tax rates proposed by Gov. O'Malley. The tax is progressive and only the state's wealthiest earners would pay more.

The current 4.75 percent flat income tax rate, which applies to "the billionaire and the person who cleans his office," is "patently unfair," O'Malley said.

His plan would lower the tax rate on the smallest incomes and gradually increase it so that those earning the most would be taxed as much as 6.5 percent, resulting in a net tax increase of $163 million a year.

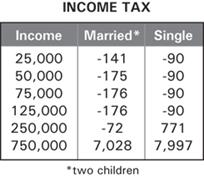

O'Malley claims that 95 percent of Marylanders would see their income tax bills go down under his plan, with married filers who earn $250,000 paying $72 less in taxes and single Marylanders earning up to $125,000 seeing a $90 reduction in their tax bills.

The 3 to 4 percent in the highest brackets, however, would make up the difference: A single person earning $750,000 would pay almost $8,000 more and married couples earning the same amount would pay over $7,000 more.

"It's very disingenuous for the governor to work in some nominal, minimal, almost negligible amount at the lower end and say he's cutting everybody's taxes," said Delegate Anthony J. O'Donnell, R-Calvert. "It borders on fraudulent."

"By creating the new brackets, earners at the high end will see a 26 to 37 percent increase in their income tax bill," O'Donnell said. "It's very simple math."

But a move away from Maryland's current "regressive and unfair" tax system is one in the right direction, said Sean Dobson, executive director of Progressive Maryland.

"Obviously, there can be improvements," he said. "But overall, it's a positive thing."

O'Malley conceded that some taxpayers will be hit by this plan, but that it would make Maryland "fairer for the vast majority, and that's the way our country works."

Richard Falknor, executive vice president of the Maryland Taxpayers Association, said tax increases should be expected from O'Malley.

The governor cannot make cuts, Falknor said, because he has powerful interest groups that demand support. O'Malley has to come up with a "substantial, predictable source of additional revenue year in and year out" in order "to take care of the folks that put him in office."

"Those folks have a very governmentalist vision, their own vision, of what Maryland should be like, where prosperity and the good life comes from the government," he said. "That's not our point of view. It's economic disaster."

O'Malley is expected to unveil more tax proposals in the coming days, with his press office promising an announcement Thursday and as many as four more next week. Thursday's announcement is expected to deal with property taxes.

But the governor had few more details on his income tax plan Wednesday and he dodged questions about other tax proposals. O'Malley sidestepped the divisive issue of slots, commenting only that he is "hopeful" and "optimistic" about working toward a consensus among lawmakers.

O'Malley also said he wants to call for a special session by early November at the latest, if lawmakers can reach a consensus. For the new tax structure to take effect in January, O'Malley said there "must be a special session to accomplish this."

But not all lawmakers will be warm to the idea of raising taxes, special session or no special session.

"It's class warfare," O'Donnell said. "One would hope that Marylanders are not going to stand for these tax increases, the first of many.

"In the end, average Marylanders are going to take it in the shorts," he said.